April 14, 2020 | Buying

What’s the Cost of Buying?

The purchase price is only one of the many costs associated with home ownership. Additional costs can add up and take an unexpected chunk out of your budget. So it’s important to understand the full cost of buying a property. There are three types of home buying costs: Pre-Closing, Closing, and After Closing Costs.

Pre-Closing Costs

Home Inspection

We always recommend getting a home inspection. A qualified Home Inspector can identify or discover underlying problems in a home. To find a qualified Home Inspector, speak to your real estate professional or browse the websites of various Home Inspector associations.

Appraisal and/or Survey

Your lender (eg. your bank) may require an appraisal or survey of the property you wish to purchase before they approve financing. This is to ensure that the value of the home or property matches the sale price.

Closing Costs

Land Transfer Tax

Land transfer tax applies to all home buyers in Ontario, however, you first time buyers are eligible for a small rebate as a first-timer. Land transfer tax is calculated on a sliding scale, but there are online calculators that can help you assess this cost.

Mortgage Insurance

If your down payment is less than 20% of the purchase price you will be required to buy mortgage insurance. Rates depend on how much you are borrowing. Visit www.cmhc-schl.gc.ca, for more information.

Legal Fees

There are a number of legal documents involved in the purchase of your home. Your lawyer will perform a Title Search to ensure there are no liens against the property and will register your deed and mortgage. Visit the Law Society of Upper Canada, www.lsuc.on.ca, to find a lawyer in Ontario.

Title Insurance

Title Insurance protects you against title fraud, public survey errors, potential encroachment issues with neighbours, and more. Speak to your lawyer during the Closing period for more details.

Adjustments

Adjustments are costs the seller pre-paid that you, as the buyer, now owe since you will be living in the home. They can include: property taxes, maintenance fees, or rental fees. You will need to reimburse the seller for these costs.

Home Insurance

You must have insurance on your home before your lender will release the closing funds.

Harmonized Sales Tax (HST)

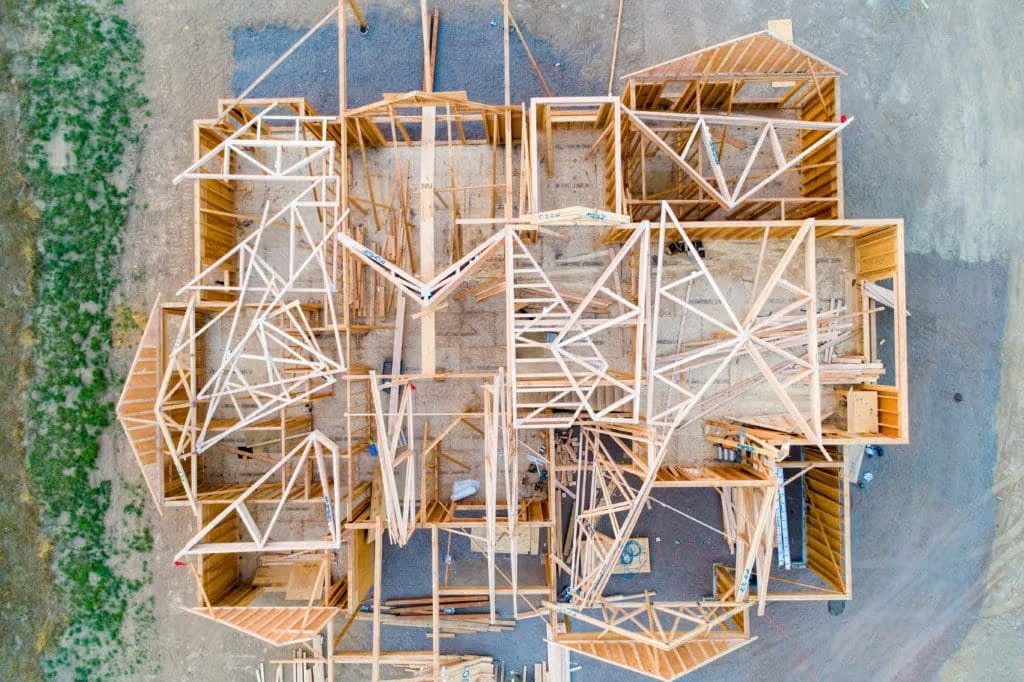

“New Builds” or newly constructed homes are subject to HST of 13%. However, buyers may be eligible for rebates from both the provincial and federal governments. HST does not apply to re-sale homes.

Tarion New Home Warranty Program

In Ontario, a warranty program guarantees new builds. This protects buyers from various issues that may emerge. It also offers deposit protection to the buyers of new builds. Sometimes the Tarion enrollment fee is included in the purchase price, other times it is due at closing. Visit www.tarion.com, for more information.

After Closing Costs

Moving Costs

Moving costs can vary widely. Ask yourself: how far you will you be moving? How much do you have to move? Will you hire professional movers or rent a truck and do it yourself? All these factors affect cost.

Utility and Service Hook-Ups

Some gas, hydro, water, and telecommunication companies charge a hook-up fee.

Renovations and Repairs

Any post-move renovations add significantly to costs. A home inspection or disclosure from the seller may identify necessary repairs.

Appliances, Furniture, and Decor

There is a good chance you will want to refresh the décor in your new home to really make it your own after move-in.

Have additional questions about buying? We can Help.